The Bitcoin price climbed back above $71,000 over the weekend, extending its rebound after one of the sharpest sell-offs of the cycle sent the price briefly plunging toward $60,000 earlier this week.

The recovery comes as institutional investors appear to be treating sub-$70,000 bitcoin as a renewed buying opportunity, even while retail traders search for signs the market has reached a bottom.

Bitwise CEO Hunter Horsley said in a CNBC interview that bitcoin’s pullback is landing differently with large investors than with long-time holders.

“I think long-time holders are feeling unsure,” Horsley said. “And I think the new investor set, institutions are sort of getting a new crack at the apple.”

Horsley added that some institutional buyers are now seeing price levels they believed they had permanently missed, as bitcoin gets “swept up” in a broader macro-driven selloff across liquid risk assets.

Retail traders are searching for a signal

While institutions have been stepping in, retail participants have been scanning the market for confirmation that the sell-off has fully exhausted itself.

Sentiment platform Santiment said in a weekend report that retail traders are “meta-analyzing” the downturn, looking for proof that others are quitting before re-entering the market — behavior that often emerges near market lows.

“Retail traders are trying to meta-analyze the market, looking for signs of others quitting to time their own entries,” Santiment wrote.

Google Trends data reflects the spike in attention. Worldwide searches for “Bitcoin” hit a score of 100 for the week starting Feb. 1 — the highest level in the past 12 months — as bitcoin’s price whipsawed from above $81,000 down to $60,000 before rebounding.

Searches for the term “crypto capitulation” also surged, rising from 11 to 58 in the week ending Feb. 8.

Federal Reserve cuts are coming for the bitcoin price

Adding to all this, ProCap Financial CIO Jeff Park suggested bitcoin price’s next major bull-market catalyst may not come from Federal Reserve rate cuts — but from bitcoin’s ability to rise even in a tightening environment.

Park described a scenario where the bitcoin price climbs alongside higher interest rates as the asset’s “holy grail,” challenging traditional assumptions about liquidity and the global monetary system.

Last week, crypto exchange Bithumb said it accidentally sent out more than $40 billion worth of Bitcoin during a promotional rewards event after a payout error gave some users thousands of BTC instead of a small cash reward.

The exchange quickly restricted trading and withdrawals, recovering 99.7% of the excess Bitcoin and stressing the incident was not caused by hacking or a security breach.

A small amount — about 125 BTC worth roughly $9 million — remains unrecovered, and Bithumb said it will cover the losses with corporate funds.

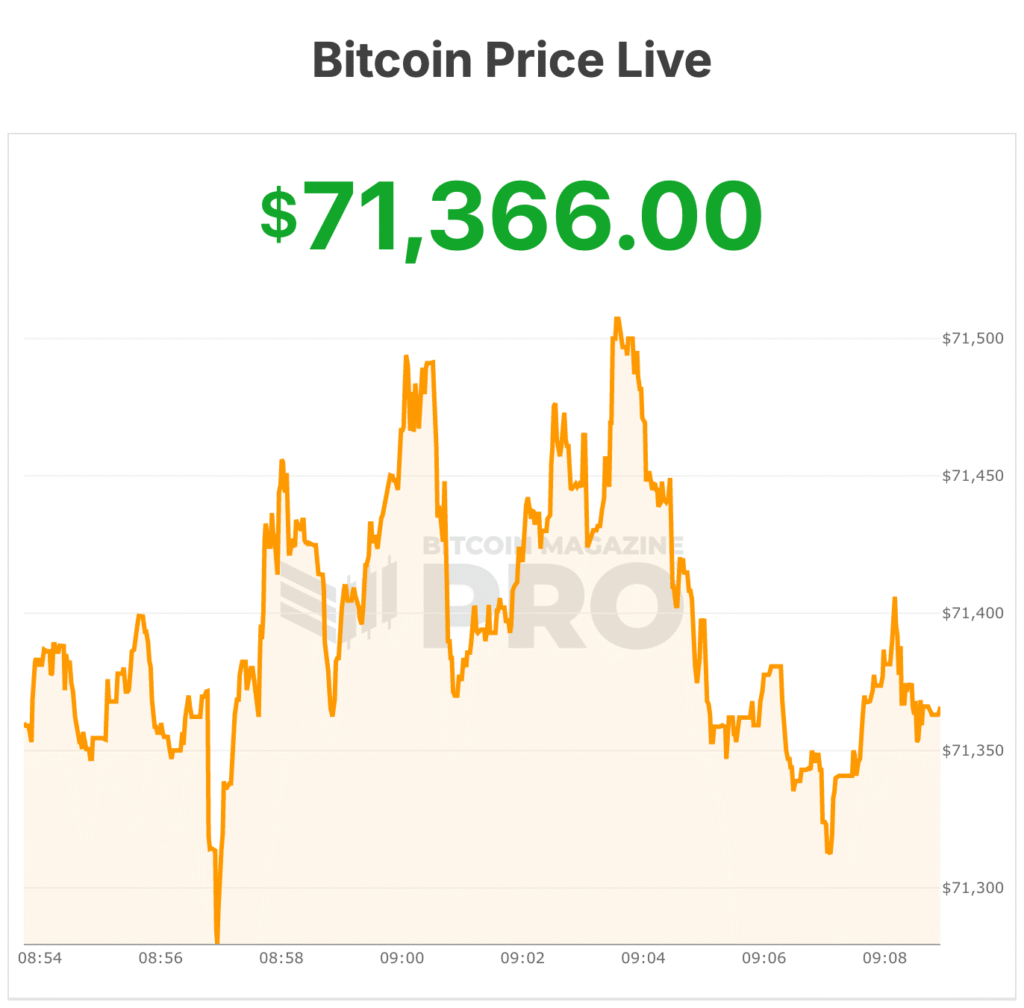

Bitcoin price was trading above $71,400 at the time of publication, stabilizing after days of extreme volatility that rattled both crypto and broader financial markets.