Humans like to make analogies to understand new things better. It makes complete sense why we would look for one in the case of Bitcoin.

Bitcoin is a novel concept to most people hearing about it for the first time, and can require great effort to grasp fully. Using the phrase “digital gold” to describe Bitcoin is incredibly palatable, and even if you don’t understand the functionality of the network, you can know certain things to be true: Bitcoin is scarce, global, and a store of value.

This narrative has worked well, ushering in institutional and nation-state adoption. The first section of President Donald Trump’s executive order establishing the Strategic Bitcoin Reserve states, “As a result of its scarcity and security, Bitcoin is often referred to as ‘digital gold’.”

On one end, we should be celebrating these incredible achievements for Bitcoin. We have made massive strides in adoption by propelling the “digital gold” narrative that should not be understated. However, for Bitcoin to reach its true potential, the narrative needs to shift.

Bitcoin is NOT “digital gold”.

Labeling Bitcoin as “digital gold” is a misrepresentation that reduces the world’s most revolutionary form of money to a mere store of value. Bitcoin’s fundamentals make even the most desirable attributes of gold completely obsolete while simultaneously being a faster, safer, more decentralized alternative to fiat currencies.

Let’s dive into what separates Bitcoin from gold.

Scarcity vs Finicity

Likely the largest selling point for gold, and why it’s survived as a store of value for thousands of years, is its scarcity.

It’s estimated that over the past 100 years, gold’s supply has only increased by around 1-2% each year. This is because there is no real economic incentive to increase the supply of gold through mining. In addition to how difficult new gold is to find, labor, equipment, and environmental compliance costs make the process extremely difficult to justify financing.

For this reason, gold has held its value well throughout history, with its monetary status dating back to 3000 BC. In the 1st century AD in Ancient Rome, you could buy a high-quality toga for the same price in gold as a luxury tailored suit today!

Gold’s scarcity and the impact that it has had on society for thousands of years cannot be understated. However, in the age of Bitcoin, continuing to measure economic value in terms of an asset with a fluctuating supply seems arbitrary.

Bitcoin is not scarce, but finite, with a set supply of 21 million coins entering circulation. There is no “gold rush” for Bitcoin, and, as technology advances, we won’t find Bitcoin on an asteroid.

Through technological and mathematical advancements, we now have the capabilities to buy and exchange cash with a fixed supply. The significance of this development cannot be understated as “digital gold”.

Microdivisability

I will concur that gold is technically “divisible” – that is, if you have a handsaw or laser handy along with a scale. However, “microdivisible” is not a word that describes gold.

Gold thrives in large transactions where expensive goods and services are being transferred. But when you start moving to smaller transactions, problems start to arise.

Below is an image of 1 gram of gold, which, at the time of my writing this, is worth ~ $108. Imagine a world where you get a sandwich from Subway, and, in exchange, you shave off the corner on a gram of gold…

That’s not happening.

Older societies throughout history understood this limitation of gold and acted swiftly to combat this by issuing coins that represented a specific concentration of the precious metal.

Although it can be difficult to pin down, it is possible that the first gold-backed currency was the Lydian stater in 600 BC. Issued in Lydia (modern-day Turkey), the coin was initially minted with electrum (an alloy of gold and silver), with a gold composition of around 55%.

In 546 BC, the Persian Empire conquered Lydia and inherited the Lydian stater. Although the Persian Croeseids initially retained a high percentage of gold in the coins, they eventually debased the currency by adding base metals like copper. By the end of the 5th century BC, the Lydian stater only contained 30-40% gold.

Gold’s inability to be a microdivisible asset is a devastating flaw, and the reason societies have never been able to truly utilize it for a significant period of time. To make small transactions, citizens choose to hand their gold to the government in exchange for 1:1 coins, which, over time, are inevitably diluted and debased by the elite class, causing the society to collapse.

There is not a single example in history where a country operating on a gold standard hasn’t eventually debased its currency in exchange for microdivisibility through coins and paper notes. This, again, is largely due to people’s ultimate need for small units of account to purchase inexpensive goods.

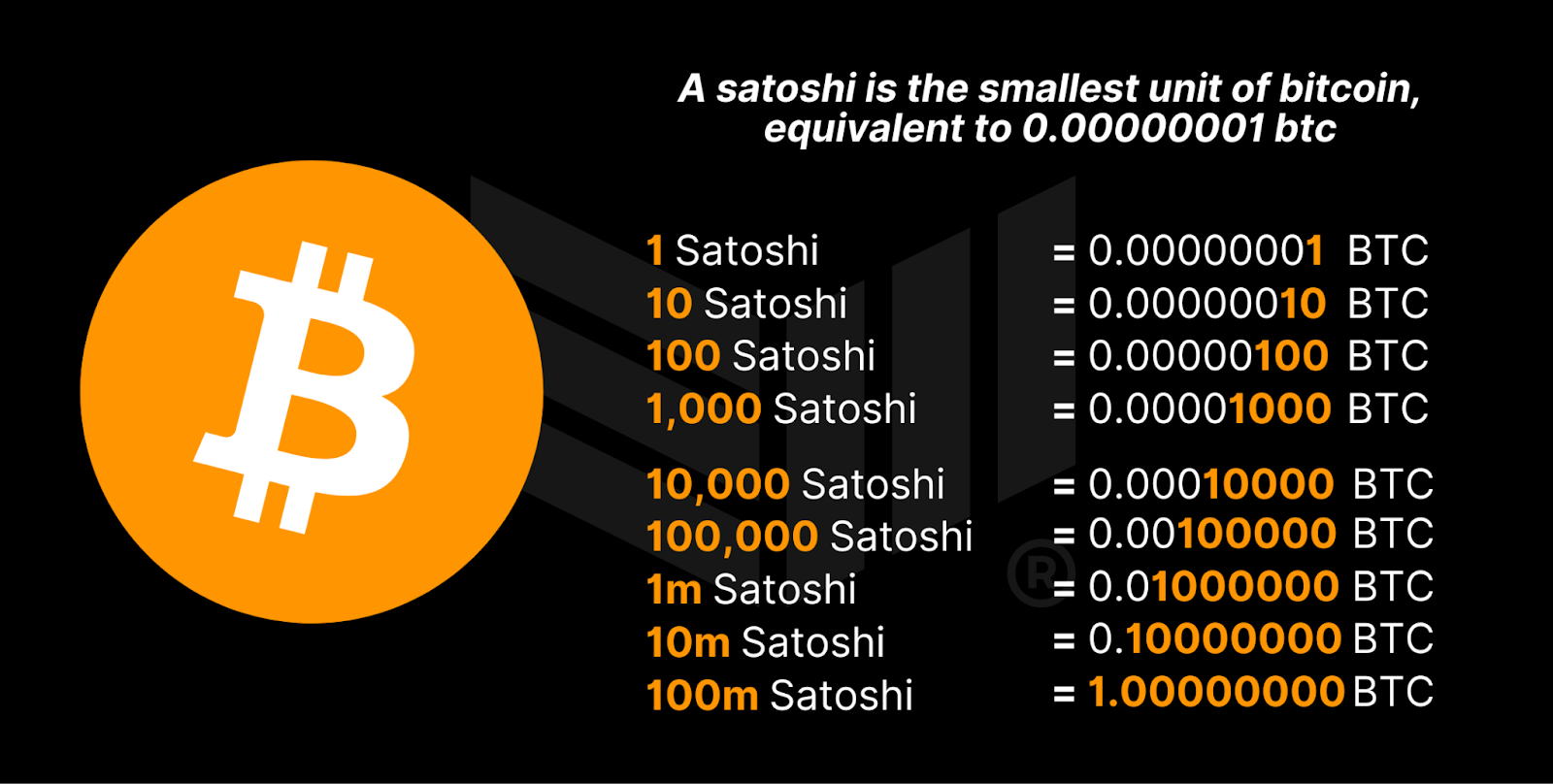

This fatal blow to gold is ultimately solved by Bitcoin. Bitcoin’s smallest unit of account is called a “satoshi” and represents 1/100,000,000th of a bitcoin. Today, one satoshi is equal to roughly $0.001, which makes it more microdivisible than the US dollar!

There is never a reason to involve governments in Bitcoin transactions because there is no need for a smaller unit of account. For that reason (among many others), Bitcoin works perfectly as money without the involvement of any intermediaries.

When considering bitcoin’s divisibility and units-of-account, it is comical to even compare it to gold in any form or fashion.

Auditability

I believe it’s a fair assumption that at the time of this article’s release, the “Fort Knox Audit” still hasn’t happened. As quickly as it became the top headline, the idea disappeared into irrelevance.

The United States’ gold holdings were last audited in 1974. After multiple decades of conspiracy theories and public speculation, President Gerald Ford decided to allow journalists inside Fort Knox. Their findings were unremarkable, with no noticeable missing gold on the premises.

However, that was 51 years ago. Today, we are in a similar position, with public curiosity piqued regarding the gold in Fort Knox.

Just a couple of months ago, the “Fort Knox Audit” seemed like it would happen any day. In fact, Elon Musk was going to livestream it! Though now, it’s beginning to seem like the elephant in the room that we’re not supposed to talk about.

Unlike gold audits, which are infrequent and manual, Bitcoin’s validation happens automatically through its proof-of-work consensus mechanism.

Approximately every 10 minutes, miners add a new block to the blockchain, verifying the legitimacy of transactions, the total Bitcoin supply, and adherence to consensus rules.

In contrast to traditional audits, which rely on trusted third-party intermediaries, Bitcoin’s decentralized process is trustless and transparent, allowing anyone to independently verify the blockchain’s integrity in real-time.

Don’t trust, verify.

Portability

It requires little persuasion to make the case that bitcoin is more “movable” than gold. Kept simply, gold in large quantities can be extremely heavy and require specialized ships and planes for cross-border transportation. Conversely, Bitcoin is held in a wallet that keeps the same physical weight regardless of the amount.

However, there is a greater distinction here that cannot go unaddressed; Bitcoin doesn’t need to physically “move” anywhere.

The most common critique of Bitcoin is that it is “not real” and “can’t be held”. However, I argue that it is one of the greatest flaws of gold. To receive a large payment in gold, you must put up the costs necessary to transport the heavy and highly valuable materials across fields, oceans, or jungles.

In addition, you must also have a high level of trust for the third parties involved. During cross-border gold transactions, you are trusting your gold with:

- The third party that brokered the transaction

- The delivery crew that took your gold to the export station

- The crew on the plane or ship that is transporting the gold

- The delivery crew that took your gold to you

- Whoever you put in charge of guarding and maintaining the gold

On the other hand, Bitcoin allows you to make transactions without needing to travel or involve intermediaries. As discussed before, the Bitcoin blockchain’s consensus protocol allows users to send money across borders without needing a third party.

This not only removes the costs associated with cross-border travel and the various individuals who may be involved, but also eliminates the possibility of fraud, as all transactions are public and on-chain for users to see and verify.

For the first time in human history, we have “electronic cash”. Bitcoin Magazine’s Conor Mulcahy defines “electronic cash” as “a broad category of money that exists solely in digital form and can be used to facilitate peer-to-peer transactions electronically. Unlike e-money, which typically involves intermediaries like banks and payment processors, electronic cash is designed to mimic the characteristics of physical cash, such as anonymity and direct exchange between users.”

The idea that a peer-to-peer transaction without an intermediary could occur without being together in person was only a theory before the creation of Bitcoin. Detractors who dismiss this advancement in our species’ capabilities as “not real because I can’t touch it” will soon realize that they are fighting a losing battle in a world that becomes more digital by the second.

Not All Bitcoin “Adoption” is Equal

If our sole aim is to drive Bitcoin’s price to the moon, the “digital gold” label will suffice. Certainly, governments, sovereigns, corporations, and individuals will continue to pour in rapidly, and the number will keep going up.

But…

If Bitcoin is the transformative freedom technology we believe it to be, we must fundamentally rethink how we educate and share it with the world. To seize this opportunity, we must prioritize educating pre-coiners on the novelty of Bitcoin and avoid oversimplified analogies. This approach will ultimately cement Bitcoin’s role as the cornerstone of global financial freedom.

This is a guest post by Isaiah Austin. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.