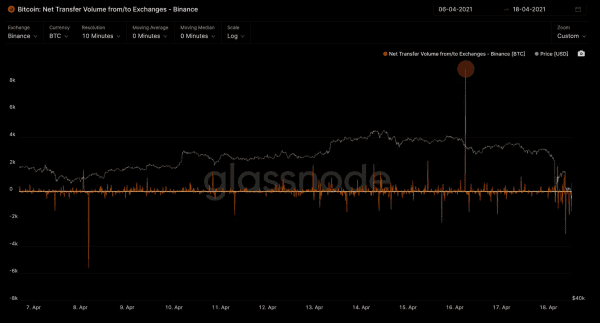

Late Saturday night and early Sunday morning, a selloff in the spot bitcoin market triggered a cascading number of liquidations across the derivatives market in a truly historic moment. Reputable blockchain analyst Willy Woo pointed to the 9,000 BTC inflow to cryptocurrency exchange Binance as the catalyst.

Open interest in bitcoin futures has continued to climb throughout 2021, and was at an all-time high of approximately $24 billion prior to the selloff, with open interest now sitting at $17.7 billion.

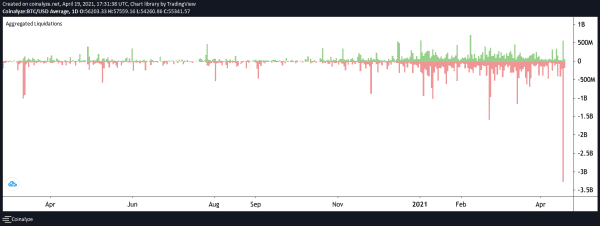

The aggregate amount of leveraged long liquidations eclipsed even the notorious March 2020 crash, with $3.4 billion in long liquidations this past weekend, compared to a total of about $1.9 billion last March.

During the liquidation event, contracts across derivatives exchanges plummeted well below spot price, with XBT/USD BitMEX contracts hitting as far as -3.02% below BTC/USD on Coinbase, presenting a great entry point for opportunistic traders.

Since the weekend selloff, the price of bitcoin has since slightly recovered, retracing back to $55,400 at the time of writing from the weekend low of $51,300.