Blockchain is the latest buzzword to draw the attention of big tech companies such as IBM and Intel, finance companies BBVA and American Express, and even automobile companies Toyota and Ford. Blockchain! Investing in blockchain. Using blockchain technology. Solving problems with blockchain. Putting things on a blockchain.

Whether it’s a new era of technological innovation or just the latest hype that will eventually die out, it’s worth asking: What is a blockchain?

Blockchain definition: A blockchain is an ordered, back-linked list of blocks of transactions, distributed across a network of computer systems. Unlike a traditional database, transactions are ordered into “blocks” and linked together to create an immutable system of information recording. A chain of blocks. A blockchain. It is one of the four foundational technologies behind Bitcoin.

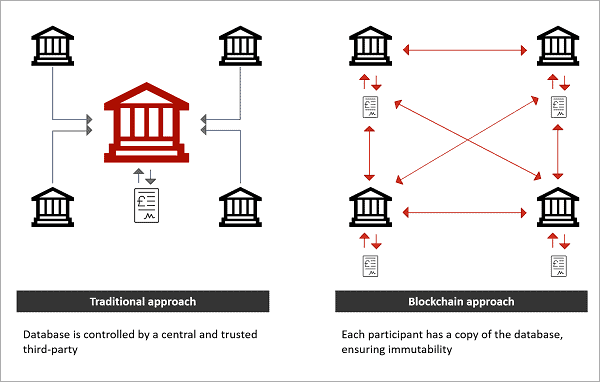

The purpose of a blockchain is to achieve decentralization so that you can verify transactions without giving up control of the network to any single entity or counterparty. This allows a system of information recording that is immutable and free from manipulation or cheating. A way to verify information without the need to trust anyone. A trustless system.

How Blockchain Works

Blockchain is a form of triple-entry bookkeeping, which removes the reliance on centralized entities such as banks and clearing houses for transaction validation. Think of it as a digital record that everyone can have a copy of, but no one can independently change. Unlike banks, which act as the sole keepers of your financial records, blockchain distributes this responsibility across a vast network. Therefore, instead of trusting one central authority, you’re relying on a communal system to transparently validate and record transactions. It’s a transformative shift from a single gatekeeper to a collective verification mechanism.

Every transaction made is broadcast to a network of participants and then grouped with other transactions to form a block. This block is then subjected to a verification process by certain network participants, commonly known as “miners” in Bitcoin’s context. Each block not only encapsulates a set of transactions but also carries a distinct code, termed a “hash,” along with the hash of its preceding block. This structure ensures that a transaction once registered remains unalterable unless the data in the subsequent blocks is modified — a feat demanding a consensus from the majority of the network.

A brief history of blockchain

On October 31, 2008, Satoshi Nakamoto (pseudonymous creator/creators of Bitcoin) published the Bitcoin white paper which detailed the concepts behind Bitcoin and blockchain technology. It was a concept that built upon and combined a series of other concepts and technologies that stretched back to 1979 and Ralph Merkle’s PhD paper “Secrecy, Authentication, and Public Key Systems,” which introduced Merkle Trees.

Stuart Haber and W. Scott Stornetta published an article in 1991 regarding the timestamping of digital documents that proposed a solution for preventing users from backdating or forward-dating electronic documents. An updated version incorporated Merkle Tree’s into their proposal.

The developer of the first digital currency, David Chaum, wrote a paper in 1982, which was the first known proposal for a blockchain-like protocol. It described a vault system for establishing, maintaining and trusting computer systems by mutually suspicious groups. His paper proposed all but one aspect of the blockchain described in the Bitcoin white paper. That one addition was Proof of Work (PoW).

In the mid ’90s, spam emails became ubiquitous, repetitive and unavoidable when commercial use of the internet was on the rise. Adam Back created Hashcash, a hash-based Proof of Work algorithm that needed a selectable amount of work to compute, making it costly for spammers whose business model relied on the ability to send large amounts of emails at little to no cost. This addition of Proof of Work (a key component of Bitcoin mining) to the many other components, allowed for the first immutable blockchain to be proposed as a digital monetary ledger in the Bitcoin white paper.

Today, there are over 30,000 cryptocurrencies running on various types of blockchains as well as many other public, private and consortium blockchains that are not used as a cryptocurrency. With thousands of blockchains now in existence in the 14 years from Bitcoin’s inception, it would seem the technology has burst into life and its popularity has exploded into the mainstream. The boom-and-bust cycles of various cryptocurrencies and the rags to riches (or riches to rags) stories that followed have created a lot of media attention — first to the cryptocurrencies themselves, then the underlying technology: blockchain. Now individuals, small businesses and even large multinational companies are all trying to harness that technology for many uses in what they see as a new disruptive technological innovation akin to the early internet.

The Technology That Underpins Blockchain

P2P Network and Distributed Ledger: A decentralized framework where participants communicate directly without intermediaries, maintaining a shared database collaboratively across various locations.

Infrastructure: The tangible hardware and systems — including nodes, miners and cooling solutions — that support the blockchain network.

Blocks and Block Time: Data clusters with unique identifiers (hashes) linked to the preceding block.

Cryptography: Encryption techniques employed to safeguard data and authenticate transactions. Notable cryptographic algorithms used in various blockchains include SHA-256 (widely recognized due to its use in Bitcoin), SHA-3 (an evolution of SHA-256 offering enhanced security) and Scrypt (employed by cryptocurrencies like Litecoin for its resource-intensive design).

Tokens of Value: Digital representations of ownership or worth within the blockchain environment.

The Consensus Mechanism plays a pivotal role, determining how nodes reach an agreement to validate and incorporate transactions into the blockchain. The consensus mechanism is one of the most important engineering choices, so we’ll discuss this in more detail below.

Consensus Mechanisms

A consensus mechanism refers to a number of different methodologies used to achieve agreement between distributed computer systems on the state of the network and/or on single data values. This is done to achieve reliability in a network between complete strangers. Although there are a number of consensus mechanisms, the two most prevalent in blockchain technology are Proof of Work (PoW) and Proof of Stake (PoS).

Proof of Work (PoW) is a type of cryptographic proof, used in a network to show participants on that network (verifiers) that an amount of computational effort has been expended by one party (the prover). This is the consensus mechanism used in Bitcoin mining to determine and safeguard the ordering of blocks on the network.

Each block on the network references the previous block, and this is what places one block after another in time. Each transaction in a block is considered to have happened at the same time and transactions that are yet to be put in a block are considered “unconfirmed.” A miner takes a set of unconfirmed transactions and orders them into a block and broadcasts this to the network as a suggestion for the next block in the chain, but so does every other miner around the world. How does the network decide which block should be included?

This is where PoW is needed. Each valid block must contain the answer to a mathematical problem. The miner runs the entire text of a block, plus an additional random guess (nonce), through something called a cryptographic hash (SHA-256) until the output is below a certain value (target). The output is completely unpredictable, so the only way to find the correct value is to make random guesses. Lots of random guesses.

At the time of writing, the Bitcoin network produces 373 exahash. This is equivalent to 373 quintillion guesses per second by the entire network engaging in a mathematical race, every 10 minutes to solve the next block in the chain in order to receive the mining rewards. To put that number in perspective, if you counted 373 quintillion seconds from the moment the universe began, it would take you to the year 11,922,881,785,984 to finish. So, when a miner finds the correct value and adds the next block to the end of the chain, you know that the miner has completed the necessary “work” in order to find the value. The PoW consensus mechanism has successfully validated billions of transactions on the Bitcoin blockchain for 14 years and has maintained its authenticity and reliability as the most secure and decentralized network ever created.

Read More >> https://bitcoinmagazine.com/technical/proof-of-work-is-important-for-bitcoin

Proof of Stake (PoS) is a consensus mechanism used on most blockchain networks, created as an alternative to PoW to achieve the same objective: achieving consensus on a network of strangers. Unlike PoW, there are no miners involved in the process.

Instead, participants in the network that want to be involved in validating network transactions and creating blocks in a PoS network have to hold a certain stake in the network, for instance by placing a certain amount of the network’s currency/tokens in a wallet connected to its blockchain. This process is known as “staking.”

When a block of transactions is ready to be processed, the cryptocurrency’s protocol selects a validator to review the block. The validator then checks if the transactions in the block are fully accurate, and if they pass the checks, the block gets added to the blockchain.

In return for doing so, the validator gets rewarded in the form of cryptocurrency tokens for their contribution. However, if a validator ends up proposing a block with information that is inaccurate, they lose some of their staked tokens as a penalty.

There are multiple variations of PoS, such as delegated proof-of-stake (DPoS), etc. These have been developed and implemented across various blockchain networks, but they all mostly work in a similar way.

Although PoW and PoS are the two main mechanisms used in various blockchains, there are other consensus algorithms like Proof of Capacity (PoC) which allow sharing of memory space by the nodes on the blockchain network; the more memory space a node has, the more rights it is granted for maintaining the ledger. Proof of Activity (PoA) is a hybrid that makes use of some aspects of both PoW and PoS. Proof of Burn (PoB) requires transactors to send small amounts of the token to inaccessible wallet addresses, in effect “burning” them out of existence.

Related >> Why Proof-Of-Work Is A Superior Consensus Mechanism For Bitcoin

Blockchain Characteristics, A Closer Look

Blockchain technology is often hailed for the unique features that distinguish it from traditional digital systems. However, it’s essential to understand that while blockchain has the potential to offer these characteristics, not all blockchains deliver on these promises equally. In fact, Bitcoin stands out as the primary blockchain that upholds these features, largely thanks to its proof of work mechanism since it fosters fierce competition at the heart of the validation process. Yet, even Bitcoin must constantly strive to maintain these blockchain attributes.

Decentralization and Transparency: At the heart of blockchain’s appeal is its decentralized nature, which allows for transparent and tamper-resistant transactions. Decentralization ensures that no single entity has control over the entire network.

Immutability: Once a transaction is recorded on the blockchain, it’s nearly impossible to alter. This immutability is primarily ensured by the PoW mechanism, which demands considerable computational power to validate transactions. The sheer energy and resources required make it virtually impossible for an individual or group to modify past data unless they control a majority of the network’s computational power.

Censorship Resistance: Often touted as a significant strength of blockchain, censorship resistance ensures transactions are processed without interference from central entities. In practice, only PoW blockchains — primarily Bitcoin — can genuinely uphold this characteristic over time.

Coercion Resistance: Due to its decentralized nature and the energy-intensive PoW mechanism, it’s exceedingly difficult for any external force to manipulate the network or the content of transactions.

Borderless Transactions: Blockchain transcends geographical limitations. It offers a platform where anyone, from any part of the world, can participate, making it a truly global system.

Neutrality: Every transaction on a blockchain is treated equally, regardless of its source or destination. This ensures that the system doesn’t favor or discriminate against any participant.

Security: Security is a cornerstone of blockchain systems. Bitcoin, with its PoW foundation, emphasizes this aspect. The significant computational power needed to compromise the blockchain makes attacks both costly and improbable.

Trustless System: Unlike traditional systems that rely on intermediaries to foster trust, blockchain operates on a trustless model. Users don’t place their trust in any single entity but in the system’s robust cryptography and consensus mechanism.

Types of Blockchains

Public blockchains: In order to be decentralized, public blockchains are open. They don’t have any restrictions on who can access them: Anyone having a computer with good hardware and an internet connection can participate in the network and also participate in the verification process of transactions or records. Bitcoin is a public blockchain.

Private blockchains: These blockchains are not decentralized and may even be fully centralized and controlled by a single entity. Only selected nodes can participate in the process, making it more restrictive than public blockchains. They usually operate in a closed network, allowing only certain users/groups to use the blockchain. Walmart is using a private blockchain, developed by DLT Labs, to help with supply chain problems.

Consortium blockchains: This is a creative approach that solves the needs of the organization. This blockchain validates the transaction and also initiates or receives transactions. It is a type of network with fewer known participants. It uses a voting-based system to ensure low latency and more speed. Each node is allowed to write the transaction but cannot add a block by itself. On the other hand, each block added by another node needs to be verified before it gets added to the network. This requires cooperation and trust within the small group of users. Tendermint is an example of a consortium blockchain.

Permissioned blockchains: These are blockchains that require access to be part of. In these blockchain types, a control layer sits on top of the blockchain that governs the actions performed by the participants that have been given access. Some give special and designated permissions to perform only specific activities on the network. Permissioned blockchains work differently than private and public blockchains. They are crafted to take advantage of blockchains without sacrificing the authority aspect of a centralized system. Hyperledger is a permissioned blockchain.

How are Blockchains being used

As blockchains enable the direct transfer of data without third-party intermediaries, the predominant use case of blockchains is money, most notably Bitcoin, certain cryptocurrencies, stablecoins and CBDCs.

Additionally, they’re being employed to address identity challenges, with decentralized digital identifiers offering secure and accessible digital IDs. Supply chain monitoring supposedly benefits from blockchain’s ability to eliminate paper trails, enhancing efficiency and real-time tracking. The technology is also being applied to real-world title transfers, with proponents claiming to make processes like real estate transfers more transparent and paperless. Furthermore, the gaming industry is leveraging blockchains for “play & earn” models and ensuring genuine ownership of in-game assets.

Beyond these applications, blockchains are making strides in areas like data sharing, domain names, smart contracts, digital voting, retail rewards and equity trading. These are use cases that are either already in operation or envisioned for the future.

Blockchain Challenges

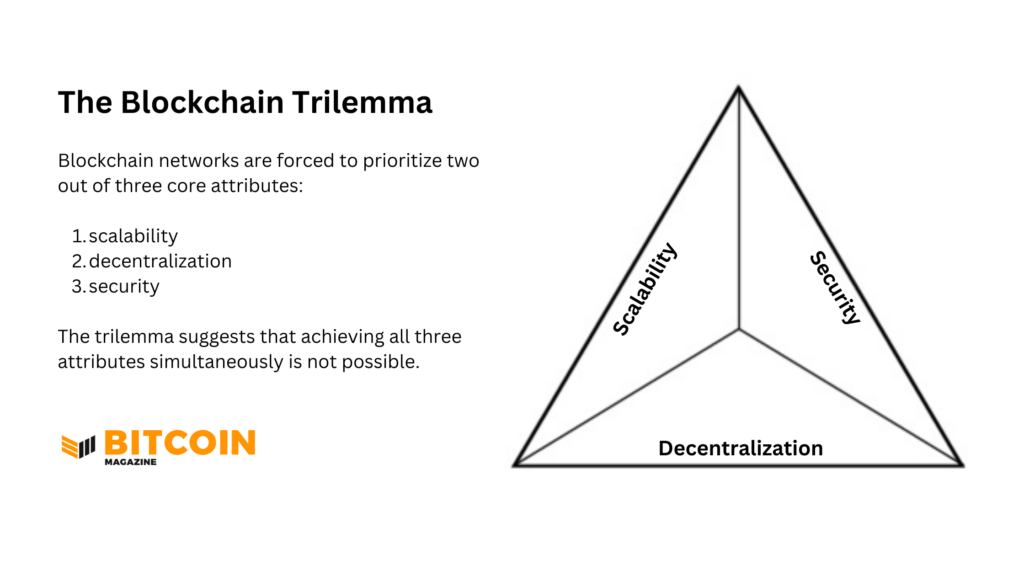

The Blockchain Trilemma

The blockchain trilemma is a fundamental challenge faced by blockchain networks, forcing them to prioritize two out of three core attributes: scalability, decentralization and security. The trilemma suggests that achieving all three attributes simultaneously is not possible.

Bitcoin prioritizes security and decentralization, relegating scalability to secondary layers, known as Layer 2 solutions. Conversely, most blockchain networks have opted for scalability, at the expense of security. This trade-off leads to vulnerabilities, including susceptibility to attacks, loss of immutability, diminished property rights and creeping centralization.

Interoperability

Most blockchains operate in silos, unable to exchange information or value with one another directly. Whilst some blockchains make solving interoperability their raison d’etre, getting more two or more complex systems to talk to one another is easier said than done, especially considering the average lifespan of a blockchain is just 1.22 years and only 8% of those on Github are actively maintained.

Data Integrity

It is often said that truth can be elusive and subjective. The adage “the map is not the territory” aptly captures this notion. While a map might resemble its corresponding territory, it’s inherently imperfect, lacking a one-to-one correspondence. This principle holds true in the digital domain, with computation serving as the sole bridge to the tangible world due to its real-world energy requirements. Trusting an oracle to enter data invariably introduces subjectivity and corruption. Hence, the most valuable blockchains are those that operate as closed systems without any input from oracles, safeguarding them from external influence.

Privacy Concerns

In a world where blockchain transactions become centralized, privacy concerns escalate. Centralized blockchains mean that everyone’s transactions are on public record, allowing for potential tracking and censorship. The implications of such a scenario are profound, with individuals’ financial and transactional privacy at risk of exposure to entities like “Big Brother” or chain analysis firms.

Effeciency

Despite their transformative potential, blockchains face efficiency challenges. They cannot process transactions as swiftly as centralized clearinghouses. This limitation can be a bottleneck for applications requiring high transaction throughput.

Complexity

Blockchain systems, especially those prioritizing scalability, inherently become more complex. As Vitalik Buterin, the co-founder of Ethereum, rather ironically points out, “Proof of work is based on the laws of physics… Whereas because Proof of Stake is virtualized… it is basically allowing us to create a simulated universe with its own laws of physics.” Building blockchains not grounded in reality necessitates continuous complex code upgrades, forks and other modifications to ensure operational stability. In other words, Proof of Stake systems are inherently unstable.

As complexity increases within systems, the threat of technical failures and centralization grows larger. Péter Szilágyi, the lead core Ethereum developer warns that complexity has gotten out of hand, and “if the protocol doesn’t get slimmer, it’s not going to make it.”

Bitcoin versus Blockchain

Bitcoin was not the first digital money but it was the first digital money that eliminated the need for trust. This was achieved through the many ingredients that make Bitcoin possible, many of which predate Bitcoin by decades. It is the culmination of those decades of work and individual ingredients that make Bitcoin what it is. Bitcoin is not its code, or its community, its nodes, its miners, its block size, its consensus algorithm or its history — it’s all of these things combined and more. Before Satoshi had even released Bitcoin’s code, he described the way in which the data is structured as a “Timechain.” Only later did people start to call it “Blockchain.”

Given that the purpose of a blockchain is to achieve decentralization so that you can verify transactions without putting trust in a central authority or counterparty, the only sensible reason for using this way of recording and structuring data is as a monetary ledger.

You can separate Blockchains into two broad categories: those without a token of value and those that have a token of value.

Blockchains without a token of value

Those that do not have a token of value are usually private blockchains or permissioned blockchains that have a central authority. The problem here is that it does not fit the purpose of blockchain, which is to achieve decentralization. One can only assume that the reason for structuring the data in this way is to capitalize on the hype surrounding “Blockchain” as using a centrally controlled database would be a much more efficient method.

Public blockchains that have no token of value and that are open and permissionless eventually run into issues regarding security, as it’s the token of value that provides an incentive structure for remaining honest.

Blockchains with a token of value

For a blockchain to achieve decentralization, there’s a few key components that make that possible, such as having a token of value which is essential to the security of the network. So, in order to achieve decentralization on a network of strangers, you need to be able to validate transactions without giving up control of the network.

The best method for decentralizing the process of validation is a consensus algorithm that depends on competition. In order to have a competition you need risk and reward. To have a reward that’s meaningful, you need something of value that miners/validators are trying to get, which keeps them playing fair. We want those that are validating/mining to be honest. So, we need that token of value.

Without that token of value, we don’t have the basis for the competition. Without the basis for competition, we don’t have security since the incentive for playing fair has been taken away. If we don’t have security then we have to control validation centrally, which introduces a layer of trust in the network of strangers, which means you don’t have decentralization. If you don’t have decentralization, then you’re using a blockchain when there’s no need to and a centralized database would be much more efficient.

As blockchains need a token of value to have any chance of surviving long term, due to the inevitable security concerns of having a blockchain without a token of value, all blockchains are essentially competing as money. All monies are subject to competitive network effects and money tends to one based on its monetary properties.

That’s a losing battle, because Bitcoin has already won.

FAQs

Are blockchains different from cryptocurrencies?

Yes. Blockchains are the underlying technology that powers cryptocurrencies. Cryptocurrencies are the digital assets or tokens that operate on blockchains.

What’s the difference between a database and a blockchain?

Database uses centralized storage of data, as opposed to the decentralized data storage of blockchains. Databases store data using “table” data structures, while blockchains store data in blocks. Databases also require an administrator to manage the stored data, which blockchains do not. Information stored in databases is regularly modified, while on blockchains, the data entries are permanent.

Will blockchain replace banks?

While blockchain has the potential to revolutionize many banking processes, it’s unlikely to completely replace banks as they serve different purposes. Instead, many banks are adopting blockchain technology to enhance their services.

Will blockchain replace cloud computing?

No, blockchain and cloud computing serve different purposes. However, blockchain might complement cloud computing in areas like data security and transparency.

Can blockchain be hacked?

While blockchain are thought to be secure due to their decentralized and cryptographic nature, they are not immune to attacks. Vulnerabilities can arise from software bugs or poorly designed smart contracts, the size of the blocks or choice of consensus mechanism. Bitcoin is set apart from most blockchains in this respect and is considerably more resistant to most attack vectors.