Bitcoin has continued to rise, crossing $123,000 earlier today, as analysts at Bernstein said they expect a “long and exhausting crypto bull market” of $200,000 per Bitcoin by early 2026.

This bull market stands apart due to increasing involvement from major financial firms, asset managers, and banks, according to Bernstein. ETFs have become a key driver, with over $150 billion in assets now parked in Bitcoin ETFs alone. BlackRock’s IBIT leads the pack, holding more than $84 billion in BTC, helping push institutional adoption to new highs.

“Our conviction in blockchain and digital assets has never been higher,” said Bernstein analysts.

“It is easy to dismiss the current cycle as yet another crypto bull market (another 2021!!). And you may call us ‘believers’ but we suspect, we may have crossed the ‘belief’ stage,” mentioned lead analyst Gautam Chhugani. “We are seeing on-ground adoption and widespread integration with the traditional financial system, backed by regulation. You may want to err on the side of our belief this time.”

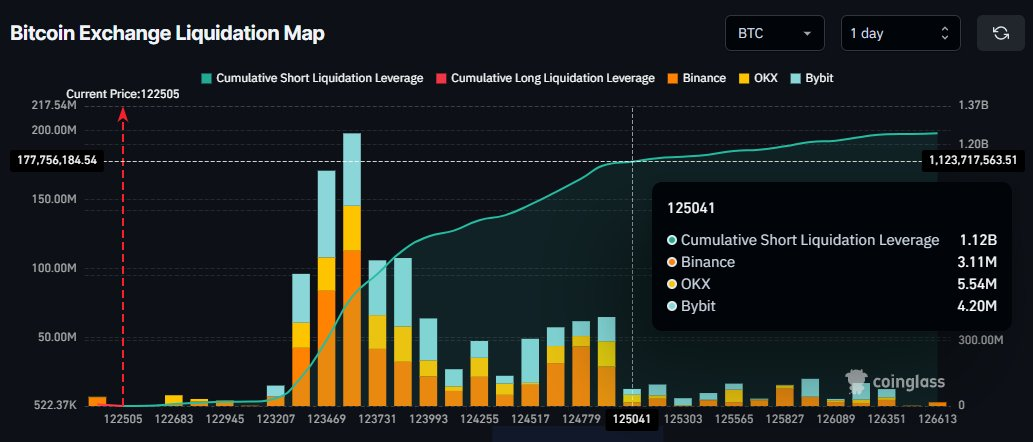

According to data from Coinglass, $1.8 billion worth of Bitcoin shorts were liquidated in the past hours and over $1.12 billion are set to be liquidated at $125,000. If Bitcoin continues its bullrun, a massive short squeeze will be triggered, forcing bearish traders to buy back in at higher prices and pushing Bitcoin even higher.

The US is also expected to become more involved in Bitcoin and other crypto as new laws like the Clarity and GENIUS Acts create clear rules for companies working in Bitcoin and crypto. These laws aim to move more Bitcoin and crypto activity back to the US and help upgrade our financial system.

Market sentiment remains bullish. According to Polymarket, there is a 59% chance that Bitcoin will hit $125,000 by the end of July, with a 29% chance of reaching $130,000. Traders are increasingly pricing in higher targets as momentum builds.

As of July 14, the top 100 public companies now hold a combined 858,723 BTC. In just the past week, 12 companies increased their Bitcoin holdings, signaling growing confidence in Bitcoin as a strategic asset.